How to find a business's VAT number? Experlu

Berikut ini adalah beberapa cara untuk mendapatkan VAT Number: 1. Registrasi di Kantor Pajak: Langkah pertama yang harus dilakukan adalah mendaftarkan perusahaan Anda di Kantor Pajak terdekat. Anda perlu mengisi formulir aplikasi dan menyertakan dokumen-dokumen yang diminta oleh Kantor Pajak.

How to apply for a VAT number? Step By Step VAT Registration UK

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

VATID Check All important information for EU merchants eClear AG

VAT number adalah singkatan dari Value Added Tax atau Goods and Service Tax (GST) yang lebih dikenal sebagai Pajak Pertambahan Nilai (PPN) di Indonesia. PPN sendiri merupakan pajak yang dikenakan dalam setiap proses produksi maupun distribusi barang.

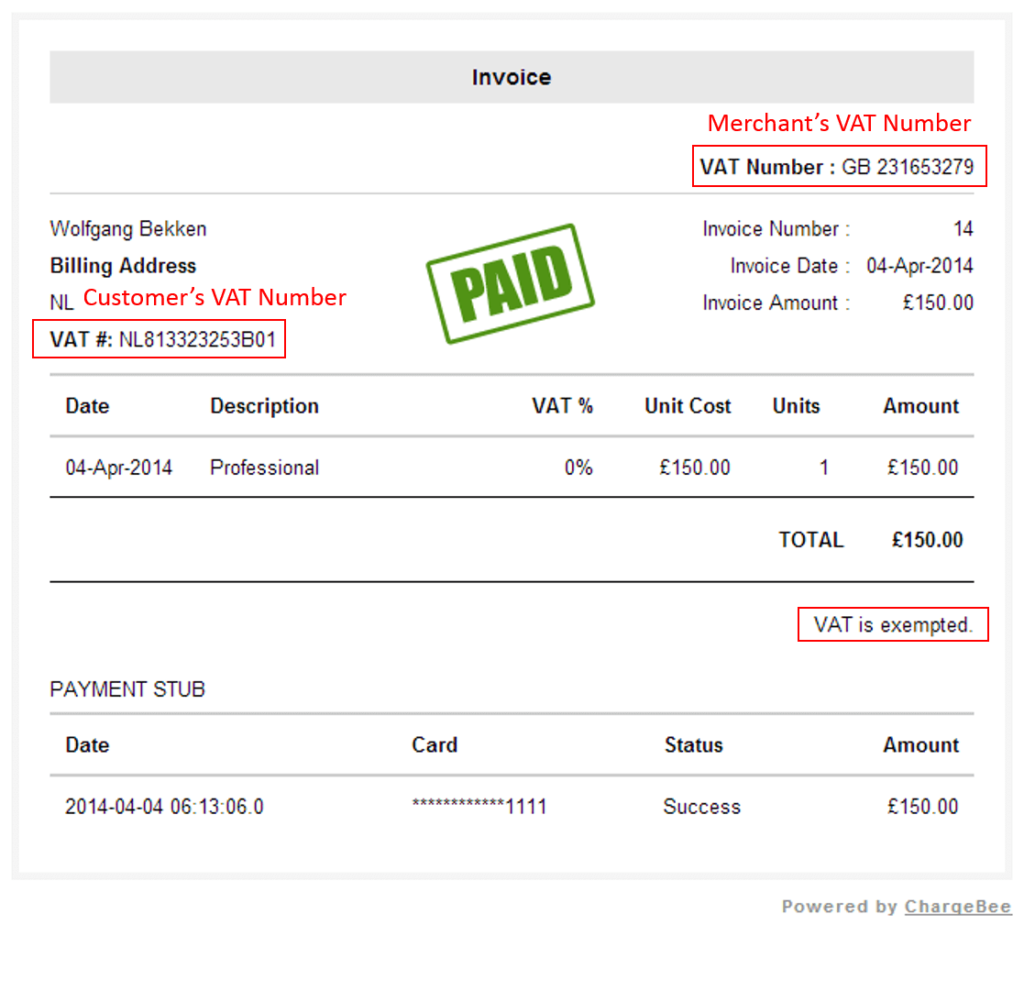

Can My Invoice Include a VAT Number or Tax ID?

What is VAT tax in Indonesia? Value-Added Tax (VAT) is the tax imposed on most products and services in Indonesia. It is the consumption tax applied to each of the production stages up until the final stage, which is selling the product. VAT rates in Indonesia The VAT rates in Indonesia are as follows:

Handling VAT Identification No. and Group VAT ID AppVision Kft.

Adobe and Indonesia VAT laws. Adobe is applying Indonesia Value Added Tax (VAT) on electronic services (e-services) starting in September 2022. This tax applies to transactions in Indonesia by companies that supply e-services, including Adobe.

VATnumber. What is that and how to get it? CloudOffice

PDI-P.COM - Pengertian Vat Number Adalah. Vat Number (Nomor PPN) adalah kode identifikasi yang digunakan untuk tujuan perpajakan, terutama dalam konteks penggunaan Pajak Pertambahan Nilai (PPN). Nomor ini diberikan kepada perusahaan atau individu yang terdaftar sebagai pengusaha, dan harus dicantumkan dalam setiap faktur yang dikeluarkan atau.

How VAT works and is collected (valueadded tax) Novashare

VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool.

VAT Number

VAT Number atau Nomor Pajak Value Added adalah nomor identifikasi pajak yang diberikan oleh pemerintah pada bisnis yang diwajibkan untuk mengumpulkan pajak nilai tambah dari pelanggan dan membayarkannya pada negara. VAT Number biasanya diberikan pada bisnis yang telah mencapai batas omset tertentu.

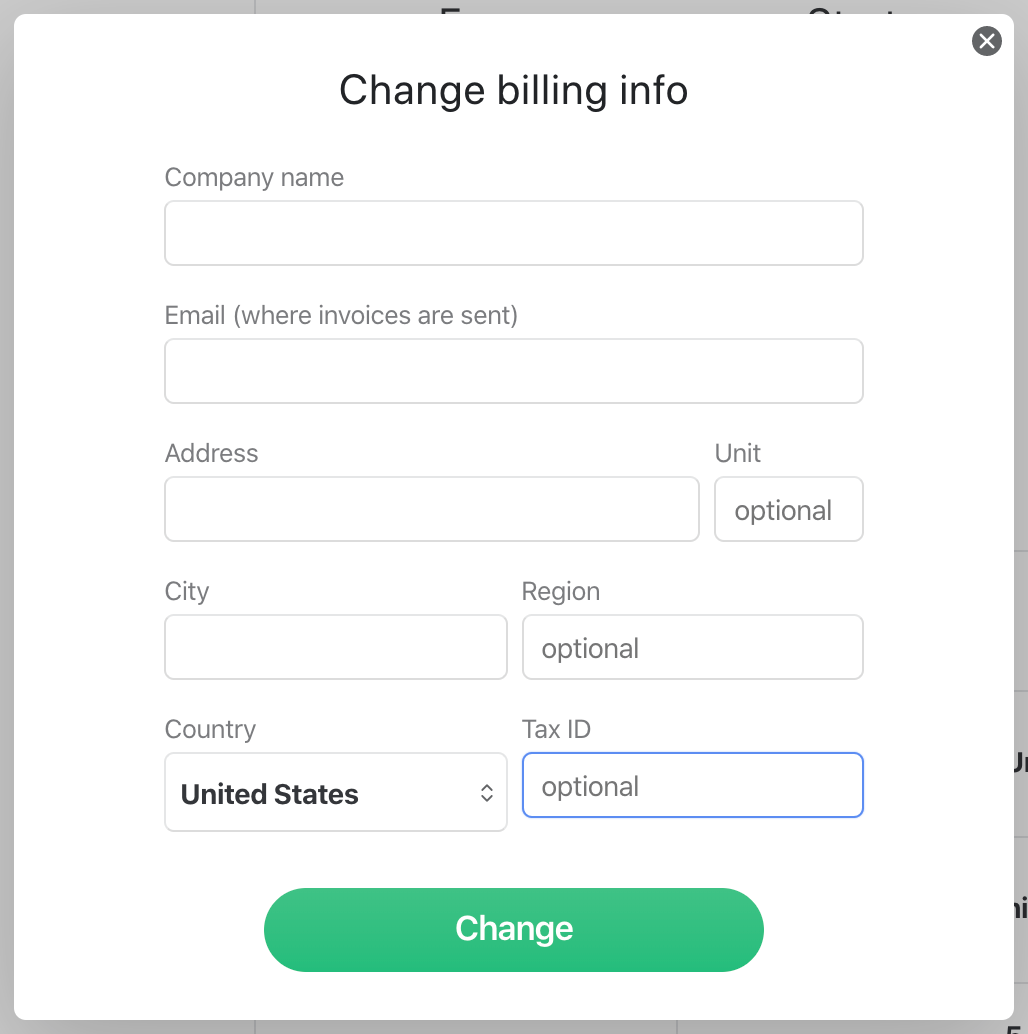

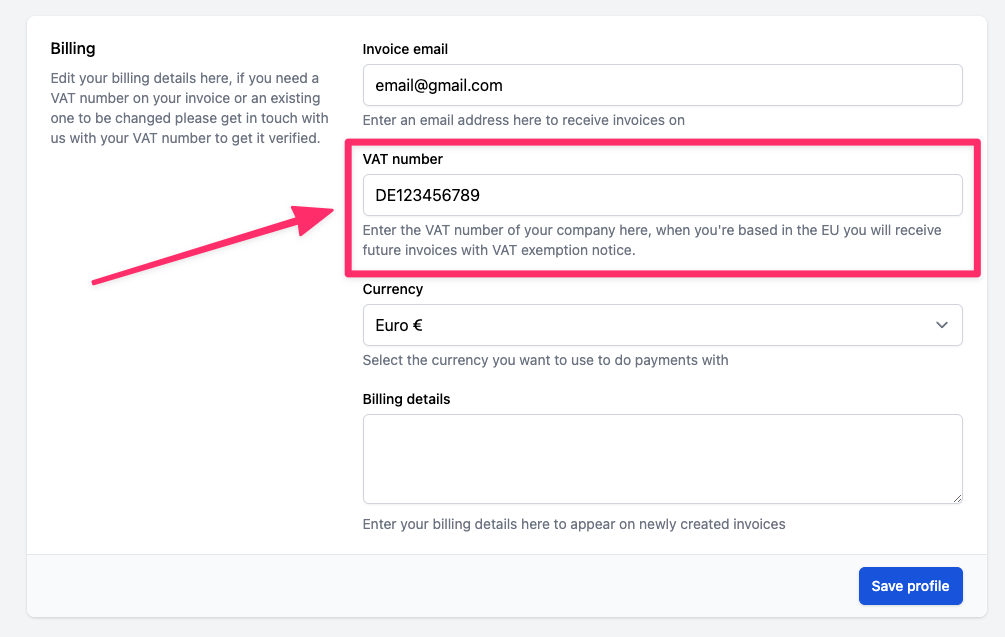

How do I apply my VAT number? Server Management Tool

the value of transactions with buyers in Indonesia exceeds IDR 600,000,000.00 in 1 year or IDR 50,000,000.00 in 1 month; and / or the amount of traffic or access in Indonesia exceeds 12,000 in 1 year or 1,000 in 1 month. The applicable VAT rate is 10 percent.

Brexit UK VAT number validation

What is a VAT number and how can I get one? Getting a VAT number means obtaining a tax identification number in a foreign country to carry out trading taxable activities. You should not confuse getting a VAT number with setting up a branch (permanent establishment) or incorporating a subsidiary.

VAT Number Atau PPN Pada Produk DIgital, Apa Pengaruhnya? idmetafora

The rate of VAT for the supplies made by Zoom to customers in Indonesia (i.e., digital services) is currently 11%. Generally, VAT is collected by the business operator who supplies goods or services to its customers. The VAT is invoiced by the supplier along with the transaction price and collected from the customer.

How VAT works and is collected (valueadded tax) Perfmatters

GST (Goods and Services Tax) dikenal juga sebagai VAT (Value Added Tax) yang dikenakan pada barang dan jasa atau layanan publik. Di Indonesia sendiri, GST disebut sebagai Pajak Pertambahan Nilai (PPN) yang mana tarifnya sendiri sebesar 11%. By Rani Maulida Published on April 17, 2023 Sekilas tentang GST

VAT Number The Ultimate Guide Bansar China

Validation results include company's name and address, if provided. You need company's tax identification number (TIN), which is also used to check VAT registration status. Enter Thai TIN in the following format: TH and number that can have 13 digits. Please note that prefix TH is added for convenience.

What is a VAT number?

About value added tax (VAT) Some countries require their businesses to register for value added tax (VAT) and add a VAT registration number to their ad account. A VAT registration number is a unique identifier for the collection and remittance of VAT to the appropriate tax authorities. The specific registration thresholds and signup processes.

VAT Produk Digital Luar Negeri Berlaku Agustus 2020 Klikpajak

The importance of VAT numbers. Used to identify tax status of the customer. Help to identify the place of taxation. Mentioned on invoices (except simplified invoices in certain EU countries) Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that.

What is the VAT Number? iContainers

VAT adalah pungutan atau pajak yang dikenakan dalam setiap proses produksi maupun distribusi barang. Jika ditilik dari singkatannya, VAT adalah singkatan dari Value Added Tax atau Goods and Services Tax (GST) atau yang lebih sering dikenal sebagai Pajak Pertambahan Nilai (PPN) di Indonesia.